Frequently Asked Questions

Frequently Asked Questions PDF download here.

-

CSB is transitioning to a new platform to improve your online user experience by providing a more intuitive and easier to use solution that offers:

- Updated user interface and enhanced user experience

- Intuitive Navigation

- Personalization Options to customize your view and simplify your workflows

- Integrated Payment Center

- New Enhanced Mobile solution

- Responsive design to provide a consistent view regardless of device

-

Customers are expected to be transitioned to the new platform starting in the 2nd Quarter of 2022. You will receive multiple communications with specific instructions as your transition date approaches. We are committed to a smooth transition and our mission is to manage a successful implementation within the projected timeframe.

-

Our Contact Center and our Business Client Service team along with your Bank Representative will be available to support you and your team during this transition.

We are developing a variety of training tools to provide education on the new platform, including user guides, product videos and reference documents. All training tools and materials will be included in our Resource Center in advance of your transition.

-

Yes, you will be able to use the same credentials you have to login in the existing platform. However the URL you use to access the platform will change to https://businessonlinebanking.cambridgesavings.com/dbiqp.

-

The access to the existing platform will be removed on your go-live day. However, all your data including account history, payment templates and users’ profiles will be available in the new platform. Additionally, for mobile users, a new app will be available for use. Instructions to download the new mobile app will be provided in advance of your transition.

-

Account history, User Entitlements and Limits, Payment Templates (including recurring and futured dated) will all be available when you login into the new platform the day of your conversion.

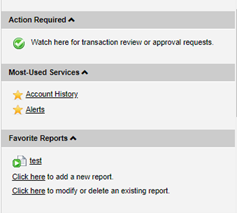

Favorite Reports which are account balances and transaction reports that you have added as “Favorite” in your dashboard as well as Alerts that you have created in the system will not be transitioned and will need to be re-produced. We recommend you print or export a sample of the reports you would like to continue to use in the new platform prior to your conversion day, following the steps below so you can use them as reference when re-creating these reports and alerts in the new platform.

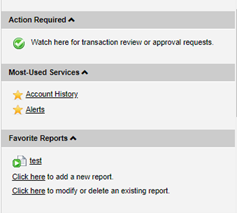

To export your favorite report, click on the specific report under Favorite Reports in your Dashboard

Click on “Export As” to export as a CSV file.

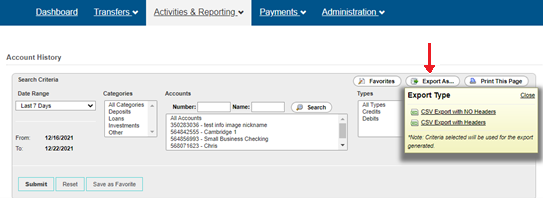

To access your alerts, click Activities & Reporting/Alerts to review your contact points and the alerts you have set up.

-

CSB has outlined a communication plan to help you and your organization prepare for your transition. Communications are scheduled as follows:

Timing Content of Communication Approximately 45 days prior to your transition day - Receive transition date

- Access to transition and training materials

Approximately 30 days prior to your transition day - Reminder transition date

- Action items to do prior to transition

- Access to additional transition and training materials

Approximately 2 weeks and 1 week prior to your transition - Reminder email

- Action items to do on Go Live Day

Approximately 1 day prior to your transition day - Reminder email

-

There are few maintenance activities that can be done which will help with the transition process as outlined below:

- We recommend that Business Online Banking Administrators review all users with access to the system and confirm the information on the user profile is correct, including their email address. Remove access to the system for any users that no longer need access.

- Review and determine which Favorite Reports you would like to use in the new platform, print or export a sample for future reference.

- Make note of the alerts you have created so you can re-create them on go-live day.

-

Below are some differences between the 2 systems that you want to consider:

Functionality Existing Platform New Platform Account Reporting Multiple tabs to access various reporting functions (Acct history, Previous Day, etc..) Account Reporting consolidated under Balance & Transaction Reporting tab. Payments Multiple tabs to access Wires, ACH, or Loans Consolidated view of all payment types on an Integrated Payment Center workspace Statements Located under Statements Located under “Other Services” tab Links to other Platforms (RDC, Positive Pay, Lockbox, Bill Pay) Multiple tabs to access other platforms located in different menus Links to other CSB systems are located under one tab called Other Services in the main menu

A message to “Continue” to the RDC, Positive Pay, Lockbox or Bill Pay system will be displayed to user.

-

All services that you used today will be available when you migrate to the new platform, with the exception of the QuickBooks Direct Connect Service. This function will not be available in the new platform until June 13, 2022, which is the date all our customers will be migrated to the new system. Until that date, you can download data manually from the Business Online Banking platform and upload it into QuickBooks. Please refer to our Manual QuickBooks Download Guide.

-

Depending on the functions you are using currently, below are some of actions items to perform on Transition Day:

- Re-create customized reports that you accessed on the previous platform (for more information review our Balance & Transaction Reporting Guide and/or our Now and Then Guide located in the Resource Center)

- Re-create your Alerts (review our Alerts Guide for more information)

- Download our new Mobile App (review Mobile App guide)

If you currently have a Payee Directory used for Wire or ACH, you need to categorize your payees by either “Individuals” or “Business” (review our Now & Then Guide and Payee Directory guide for more information). Refer to our Resource Center to find a variety of instructional guides and videos to familiarize yourself with the functions of the new platform.

-

No, pricing will not change with the new platform.

-

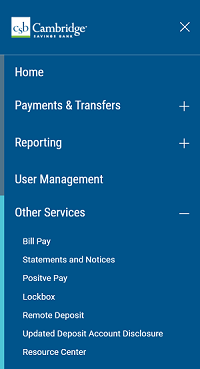

Links to Bill Pay, Statements and Notices, Positive Pay, Lockbox, Remote Deposit, Updated Deposit Account Disclosure, and Resource Center are located under “Other Services” from the main navigation menu.

-

The following browsers are supported:

- Microsoft Edge

- Googled Chrome

- Apple Safari

- Mozilla Firefox

Important! As of November 2021, Microsoft has confirmed that support for Internet Explorer 11 will cease on June 15, 2022, for the vast majority of (>97%) of the Windows Operating systems in use today. Therefore, Internet Explorer is no longer categorized as a supported browser. We strongly recommend upgrading your browser to Microsoft Edge to ensure functionality in the system works as expected.

-

The following settings and plug-ins are required to properly access the new platform.

Configuration Requirement Cookies Session = Enabled

Permanent = Enabled

JavaScript Enabled Minimum Screen Resolution 1024 X 768 pixels Adobe Acrobat Reader Adobe-supported versions -

- One Time Passcode required when logging in from a different device

- Challenge questions for first time users

- Password expiration after 120 days

- Dual approval for payment transactions

- Limits may be set at the company or user level on a per transaction, per day, per account level

- Timely alerts can be set up via e-mail or text message

- System administrator can set permissions to features at the user and per account levels

-

Date Report Type New Enhanced Platform Existing Historical Account Activity 13 Months 12 Months ACH Historical Activity 180 Days 120 Days Wire Historical Activity 180 Days 180 Days Statements 2 Years 2 Years