How Can I Afford a Home in or Around Boston?

Great question! Let's dig deeper and help you understand what you should expect

Getting Started

One way to approach this question is to break it down into three parts:

- Finding a home that meets your needs and budget

- Determining your down payment and other expenses

- Feeling comfortable keeping up with monthly mortgage payments

Read below for resources to help you understand how you can afford a home on your budget.

Find a Home Within Your Budget That Fits Your Needs

Get a Credit Approval Letter

A mortgage credit approval, also called a pre-qualification, is based on the information you provide to a lender. At CSB, we will also pull your credit report and run the information you provide through an automated underwriting system.

Research Towns and Cities

Once you understand what you may be able to afford, decide what is important to you in a home and research different cities and towns. Do you want to live somewhere with a vibrant town center, or near public transportation?

- Research different cities and towns through Livability Neighborhood Scout, or a similar site. These sites provide information about average home prices, taxes, and more.

- The Massachusetts Association of Realtors website offers market data to help you learn more about what the market is like in different towns and cities across the state.

Learn More About Your Down Payment and Other Expenses

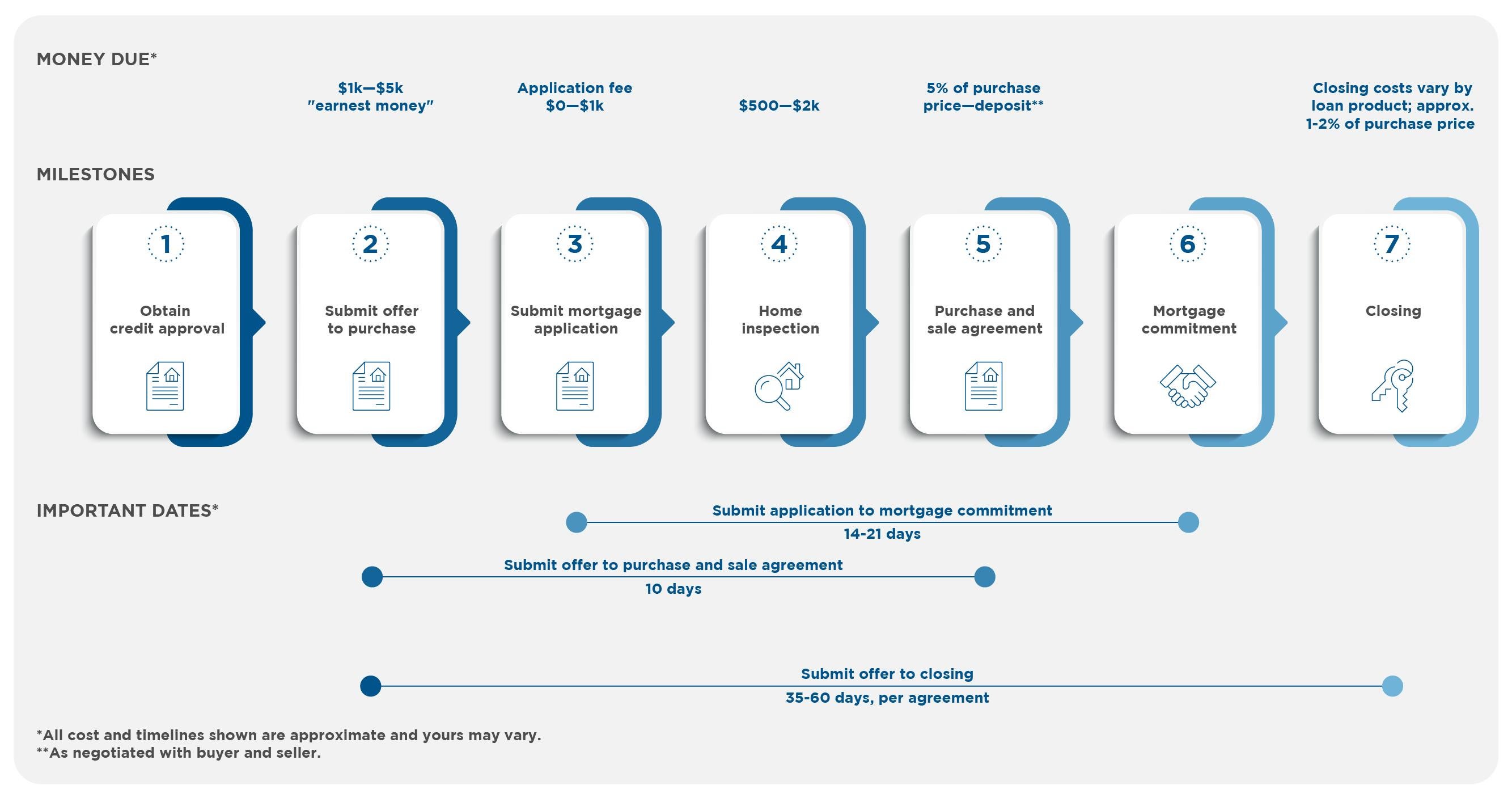

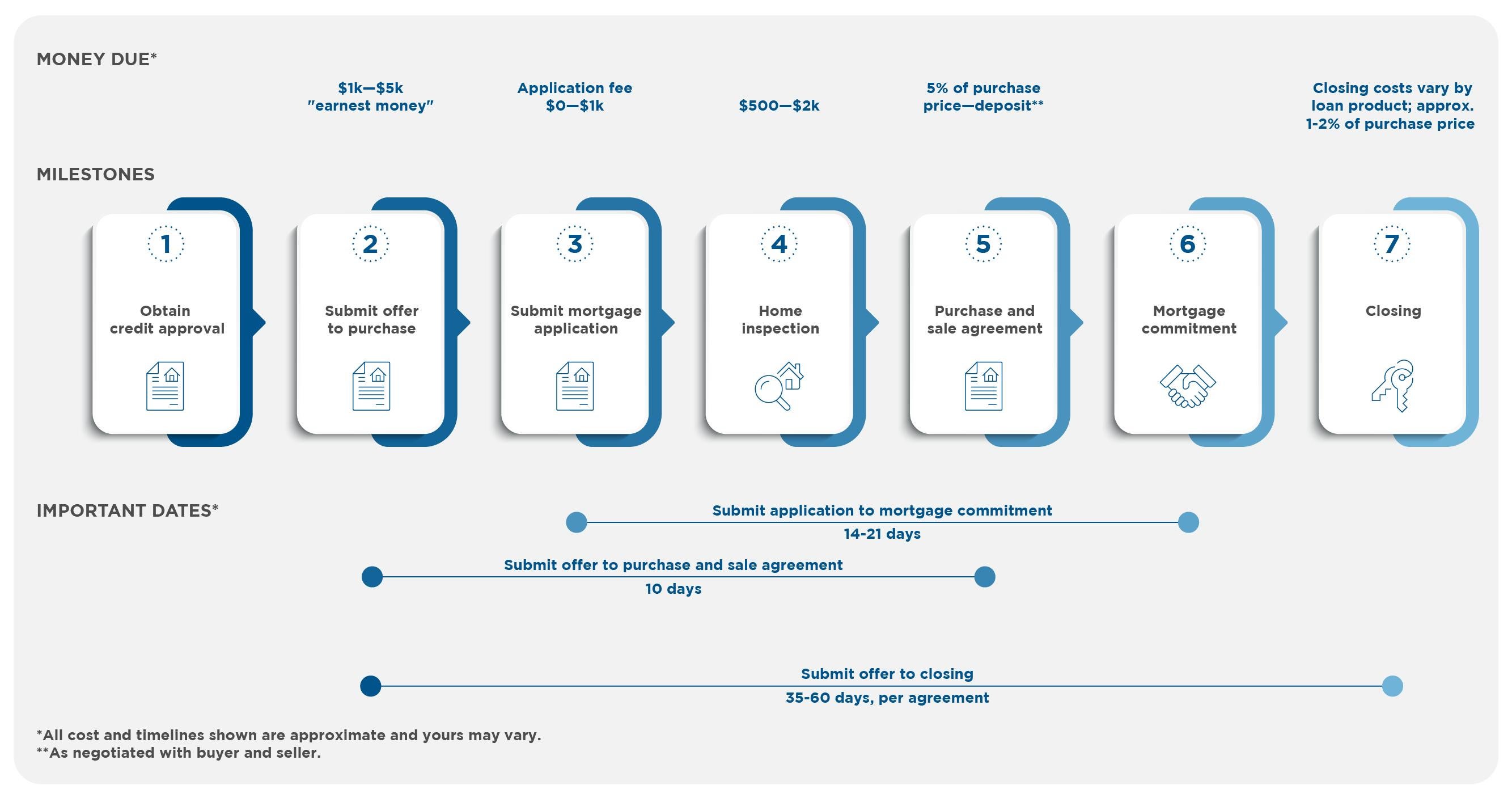

There are several key milestones that require you to have some cash ready to put down. In all, be prepared to put down about 5% of the home's purchase price in addition to the down payment.

Submitting an Offer with Earnest Money

Earnest money, also called a good faith deposit, will often be paid in competitive market situations. Earnest money is usually $1,000 - $5,000, depending on the purchase price of the home, and is placed into escrow upon payment.

Why Pay Earnest Money?

Earnest money shows a seller that a buyer is serious about their offer, and is designed to protect the seller if the buyer backs out. When a buyer makes an offer on a home, the seller takes it off the market while they go through the transaction process. If the buyer changes their mind and backs out of the sale, re-listing the house can be an expensive and time-consuming process.

Will I Get the Earnest Money Back?

It depends—let's take a look at some different scenarios.

- If everything goes according to plan and you end up closing on the property, you should get the earnest money back. Most buyers use that money toward the down payment on the home.

- If you back out of the sale for a reason you specify in your offer letter (for example, if it fails an inspection due to water damage to the roof), you should also get your money back.

- If you find a more appealing house and simply change your mind about the deal, you would forfeit the earnest money you put down.

Home Inspection

Be prepared to pay about $500-$2,000 for each home inspection.

Purchase and Sale Agreement

Be prepared to put down 5% of the purchase price of the home when you sign a purchase and sale agreement.

Submitting a Mortgage Application

Application fees can range from $0 to $1,000.

Closing

Closing costs may vary based on the type of loan, but are typically around 1-2% of the home purchase price. You may also owe additional money for the down payment at closing. Your mortgage loan officer can help explain what you owe at closing.

Feel Comfortable Keeping up With Mortgage Payments

Use Our Mortgage Affordability Coach to Check Your Assumptions

Check out this interactive affordability coach from Banzai.1 You'll be asked some simple questions about income and monthly expenses, and see an estimate of how much mortgage you may be able to afford based on the information you provide.

Learn More About Mortgage Options

When you reach out for a credit approval, you'll be introduced to a loan officer who will help match you with a loan product. At CSB, we offer many mortgage options ranging from innovative and flexible affordable loan products with low and no down payment options, to Jumbo loan products.