Frequently Asked Questions

The best banking tool around? Understanding.

Click on a topic below to jump to frequently asked questions for that topic.

If you can’t find the information you need, give us a call at 888.418.5626 or email info@cambridgesavings.com.

-

If you no longer want to use Online and Mobile Banking, you can remove your mobile/online banking user profile at any time.

If you wish to remove access, please note:

- Your User ID and password will be deleted, and you will be unable to access Online and Mobile Banking

- You will no longer have digital access to transfer or payment history and recipients/payees

- Any bill pay payments or eTransfers that are sent prior to the removal of your online banking profile will still occur. Please direct any questions regarding the status of a recurring or scheduled payment or transfer to the Customer Service Representative when you contact us. Future-dated bill pay payments or eTransfers will be cancelled at the time access to your profile is removed

- Any statements, notices, or tax forms for accounts linked to your Online Banking profile will not change to paper statements automatically. Please change your delivery preference to receive paper copies of notifications by mail in the Statements, Notifications, and Tax Forms section located in the Account Management menu before requesting deletion of your online profile

To remove your access, call 888.418.5626, send a Secure Email in Online Banking, or send a live chat message. Please remember you should never submit account and personal information through regular email.

Note: Removing your Online or Mobile Banking user profile will not close your CSB account(s). If you wish to close an account, you must do so separately by calling 888.418.5626, sending a Secure Email in Online Banking, or sending a live chat message. Please remember you should never submit account and personal information through regular email.

Mobile Banking

Apple Watch®

-

You must have an iPhone 5® or newer with iOS 8.2 or later, and that iPhone should be paired to your Apple Watch®.

-

- Go to the Apple Watch App on your iPhone (be sure you have the current version of the CSB Mobile Banking app V4.5.1, as of July 2015)

- Select My Watch

- Go to the Apple Watch compatible apps

- Select the CSB app

- Select Show App on Apple Watch and slide the bar to the right (you may also select to Show in Glances)

- Once you have your Apple Watch turned on, there will be a message that prompts you to install the app. Select Yes.

-

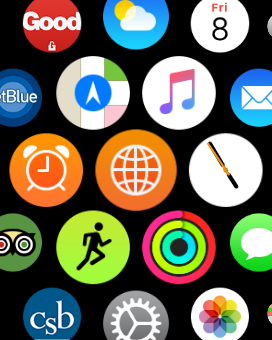

You will initially see the CSB app icon on your home screen. Upon selecting the application, you will then see the screens below:

-

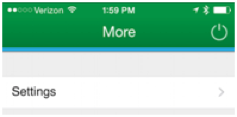

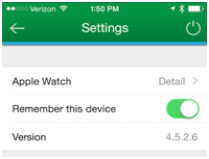

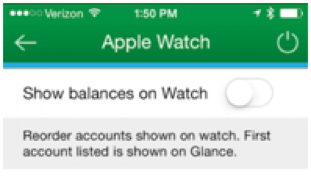

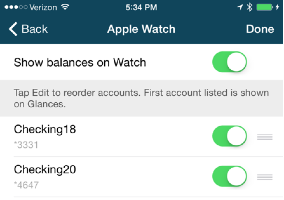

- Open the CSB Mobile app

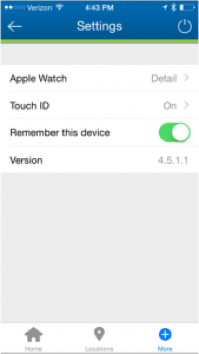

- Select More>Settings

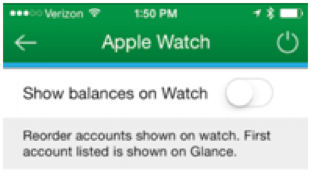

- Go to Apple Watch

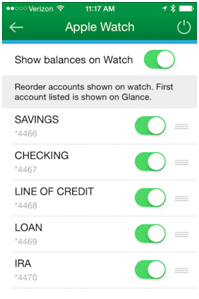

- Go to Show balances on Watch

- Once selected, choose the order of the accounts that you would like to have displayed by dragging and dropping the handles

-

- Go to Settings

- Go to Apple Watch

- Go to Show balances on Watch

- Once selected, swipe the bar to the left to hide/unhide accounts

-

- Go to Settings

- Go to Apple Watch

- Go to Show balances on Watch and swipe to the left

Important Note- You will need to hit Refresh on your Apple Watch for the changes to update

-

Glance View allows you to view the balance of your primary account at a glance from the face of your watch without having to open the CSB app.

-

- If Show in Glances is turned on (See FAQ #2), from the CSB Mobile App, select More>Settings

- Go to Apple Watch

- Go to Show balances on Watch

- Once selected, choose the order of the accounts that you would like to have displayed by dragging and dropping the handles. The first account listed is the account that will show up in Glance View.

-

- Make sure that you have previously accepted the location permissions on the phone app

- Next open the CSB Mobile app on your watch append then you can swipe from right to left to get to the branches view

- On the branches view, you can advance through different branch locations by using the “Prev” or “Next” navigation buttonsprovided below the branch map

- You can also navigate to the branch by tapping on the map and using the native Apple Watch mapping capabilities

-

Please check for the following:

- Make sure both Bluetooth and WiFi are turned on under Settings on your device

- Make sure Apple Watch is enabled in under Settings in the mobile banking application

- In the companion Apple Watch app, make sure the mobile banking application has been enabled

TouchID®

-

Touch ID is another way for you to access your CSB mobile app by using built-in, fingerprint-sensor technology.

-

If you have not used Touch ID before, upon logging in to our Mobile Banking application, you will receive a prompt that will ask you if you would like to start using it to log in.

-

Touch ID is not yet enabled for the Cambridge Savings Bank mobile application for tablets.

-

Definitely! Please follow the below steps to turn off Touch ID and use your username and password:

- When signed into the app, select More

- Go into Settings

- Go to Apple Watch

- Under Touch ID, switch from On to Off

-

Your fingerprint is only stored on your device. It is encrypted with a key that is specific to that device, and it will not leave that device.

-

This is because of a security enhancement to TouchID.

If you have added or removed a fingerprint from the device, the next time you login to the mobile banking app you will need to use your username and password then enable TouchID again.

Quick Balance

-

It is the ability for you to see your account balance and your last 5 transactions without having to log in to online banking.

-

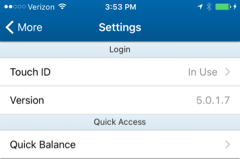

Please note that you should have version 5.0 of the CSB mobile app to be able to access the Quick Balance feature.

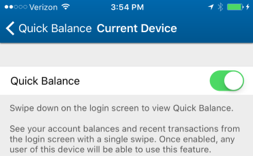

For Apple device users:

- Go to Settings/Quick Balance/Current Device

- Swipe the Quick Balance feature to the On position

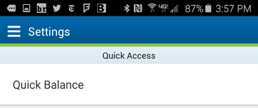

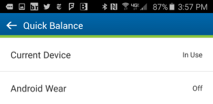

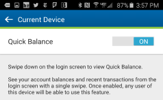

For Android device users:

- Go to Settings/Quick Balance/Current Device

- Swipe the Quick Balance feature to the On position

- Go to Settings/Quick Balance/Current Device

-

- Go to Settings/Quick Balance/Current Device

- Swipe the Quick Balance feature to the Off position

-

It is available for Apple devices with iOS 8.1 or higher and Android devices with versions 4.1 or higher.

-

You may see your balances and 5 most recent transactions by swiping down anywhere on the log-in screen.

-

Quick Balance will show you your current and available balances for checking and savings accounts.

-

Quick Balance must be enabled on each device individually. If you have both a phone and a tablet, enabling Quick Balance on your phone will not enable the feature on your tablet.

-

For users sharing a device, if the first user enables Quick Balance on the device, other users will see the first user's account balances. If another user disables Quick Balance from the app, the first user will no longer see their Quick Balance, either.

-

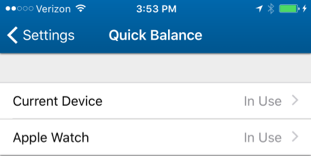

Yes, you can!

Please follow the below steps:

- Go to Settings/Quick Balance/Apple Watch

- Select Show balances on Watch

- Tap on Refresh on the watch to begin seeing balances.

Note: Any changes to the account reorder will be reflected after user clicks on “refresh” on the watch Accounts screen.

Mobile Deposit

-

Please review our Funds Availability Policy to learn more.

-

Mobile deposit is a way to electronically deposit checks for your Apple device (iPhone or iPad) and or an Android supported smartphone or tablet (including a Kindle tablet) with a functioning camera device using the Cambridge Savings Mobile Banking app.

-

To use mobile deposit, you must be a current Cambridge Savings Bank customer with a checking or savings account. You must also be enrolled in online banking and our mobile app. Before depositing your first check, you must read and accept the Remote Deposit Capture Services disclosure and agreement. Use of Mobile Deposit is subject to approval.

-

Make sure you have downloaded the Cambridge Savings Bank Mobile Banking app for your Apple device (iPhone or iPad) and or an Android supported device (smartphone or tablet, including a Kindle tablet).

- Sign into the Cambridge Savings Bank Mobile Banking app

- Choose Deposit Checks

- As part of enrollment in the service you will be asked to read and accept the Remote Deposit Capture Services disclosure and agreement (It may take up to one business day to receive approval)

- Select the checking or savings account into which you want to deposit the check

- Enter the amount of your check

- Endorse the back of your check with For Mobile Deposit Only

- Snap pictures of the front and back of your check

- Submit the check for deposit

- You will receive onscreen confirmation that your check was received.

-

Mobile check deposit is free for Cambridge Savings Bank customers.

-

After submitting images of the front and back of your check, you will:

- Receive onscreen confirmation that we have received your deposit.

- You will also have the option to email a confirmation number to yourself.

- Your check will then go through processing.

Important Notes

- Please see our Funds Availability Policy for more information about deposits.

- Please do not dispose of your check or attempt to process at another institution or through another channel (ATM or in-branch).

- You should hold onto your check for 91 days and then destroy or shred it.

-

Check deposits made through the Cambridge Savings Bank mobile banking app are protected with the highest financial industry standards.

-

There are a few common errors that may cause your check to be rejected:

- Folded or torn corners

- Front image is not legible

- Dollar amounts do not match

- Routing and account numbers are unclear

- Your device does not have a camera

- Image is too dark or otherwise unclear

Important Notes

It is best to make your mobile deposits in a well-lit area to prevent shadows and poor image quality, and keep your hands and fingers out of the image before taking the picture.

Android is a registered trademark of Google, Inc.

Apple, the Apple logo, iPhone, iPad, Touch ID, and Apple Watch are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay is a trademark of Apple Inc. -

-

Mobile Deposit in the CSB app supports Android Talkback and iOS Voiceover automatically. The largest accessibility text size supported is Medium.

Online Account Opening

-

As a security measure, CSB obtains a consumer report on all applicants. This inquiry does not impact your credit score. If you have any precautions in place, we will not be able to run the necessary verifications to evaluate your application and open your account.

-

We are unable to capture or process military ID information through our online account opening platform. If your military ID is your only form of identification, please contact us for assistance.

Accepted Forms of ID: Driver's License, State ID Card, U.S. Passport

Checking

Routing

-

Cambridge Savings Bank's routing number is 211371120.

Savings

-

APY-E (annual percentage yield earned) is an annualized rate that reflects the total amount of dividends (or interest) earned for the dividend (or interest) period and stated as a percent based on the actual average daily balance in the account. Unlike APY, which assumes no deposits or withdrawals are made over a 12-month period, APY-E is impacted by both deposits and withdrawals made during the period reflected on the periodic statements. On leap years, the APY-E listed in January and February statements may differ as calculations are based on 366 days.

Money Market Account

-

If you already have a money market account with us and need to order replacement checks2, order online, call our check provider Deluxe at 800.335.8931, or call us at 888.418.5626 for assistance.

-

Before July 1st, 2015, this will show as a checking account

After July 1st, 2015, this will show as a savings account

Important note

There are no changes to our money market accounts other than how it will be classified in our systems – checking vs. savings. -

Before July 1st, 2015, this will show as a checking account

After July 1st, 2015, this will show as a savings account

Important note

There are no changes to our money market accounts other than how it will be classified in our systems – checking vs. savings.

Abandoned Property

-

You can re-activate your account(s) by completing the following:

- Sign and return the activation form that you received with your Abandoned Property Notice

-

The person or organization named to represent the estate of the deceased can forward copies of the death certificate and their appointment papers to us for processing. We can then work directly with the representative to disburse the account.

-

State law requires either a monetary transaction initiated by the customer or a written communication from the customer to keep an account in an active status. The posting of interest payments and/or receipt of the account statement does not qualify as a monetary transaction under this law.

-

Please visit MissingMoney.com

International Wires

Incoming International Wires

-

An incoming international wire (or payment) is an electronic transfer of funds directly credited to your account from an overseas remitter. In most cases, a wire is the quickest way to receive funds from abroad.

-

A wire will normally take 2-3 business days to be credited to your account, although this can never be guaranteed.

-

The remitter should send the funds, and if in foreign currency, Convera will convert them into U.S. Dollars before forwarding to Cambridge Savings Bank for credit to your account.

Chip Card Technology

-

A chip card is a debit or credit card with a built-in microchip that provides greater security of your personal and payment information. The microchip is encrypted, which means that it is extremely difficult to copy or counterfeit, helping to further protect you against fraud.

-

Although chip cards are not yet common in the U.S., many countries around the world have been using chip cards for many years to provide enhanced protection to cardholders against fraud. Over the next few years, chip cards and chip card payment machines will become a standard in the U.S.

-

Chip card technology makes an already secure payment system even more secure by providing an additional layer of protection on every transaction, helping to further reduce the risk of fraud.

-

The embedded microchip encrypts all of your payment information, making it very difficult for someone to steal. When paying with a chip card, a unique code is assigned to each transaction and the code will be validated before the payment is processed.

-

Using magnetic stripe cards is still a safe and secure method of payment. The transition to chip card technology is the next step in electronic payments to enhance card security and further protect your payment information against fraud.

-

Instead of swiping your card to make a payment, you’ll insert your card into the front of the chip card payment machine with the chip facing up. Your card will stay in the machine until the transaction is complete. When the transaction is complete, you’ll be prompted to remove your card from the chip card payment machine.

-

Your chip card will still include a magnetic stripe on the back of the card. If a retailer does not accept chip card payments, you’ll still be able to swipe your card and pay as you normally would. However, if the merchant offers both chip card payment machines and traditional swipe machines, you’ll be required to use the chip card machine.

-

Yes, you will still enter a PIN when using an ATM. If you already have a PIN established for your card, you can continue to use that same PIN without change. If you’re receiving a new card, a temporary PIN will be issued to you in the mail. If you don’t know your PIN, please visit one of our branches for immediate PIN re-issue or call 888.418.5626 to request a new PIN to be mailed to you.

-

Yes, you can continue to use your chip card the same way you currently use it today when making purchases online, over the phone or with Apple Pay®.

-

Nothing. These are all just different terms used to reference the same technology.

-

All of our debit cards are equipped with the chip card technology.

-

There are no additional fees associated with the new chip cards.

-

Our Contact Center is here to help! Call 888.418.5626 or email your question to info@cambridgesavings.com

Mobile Wallet

-

All Cambridge Savings Bank Debit Mastercards® (with the exception of business debit cards) are offering Apple Pay®, Samsung Pay, or Google PayTM.

-

Start by having your Cambridge Savings Bank debit card on hand.

For Apple Pay:

- Simply tap the Wallet app that's already on your iPhone®

- Tap + and follow the steps to add your Cambridge Savings Bank Debit Mastercard.3

- Tap Next at which point we will verify your card information

- When prompted, please call the number displayed on the screen so we can activate your card for Apple Pay.

Learn more about Apple Pay

For Google Pay:

- Download the Google Pay app

- Sign in with your Google account

- Simply follow the instruction to get set up.

Learn more about Google Pay

For Samsung Pay4:

A Samsung Pay shortcut will be preloaded, allowing you to download and install the app. If not, download Samsung Pay from Galaxy Apps®.

- Open Samsung Pay and tap Get Started

- Enter a new PIN for Samsung Pay and enter again to confirm

- If it's your first time using Samsung Pay, you will be asked to add Payment Cards

- Add your Cambridge Savings Bank Debit Mastercard

Learn more about Samsung Pay.

-

Once your Cambridge Savings Bank Debit Mastercard is added:

- For Android Users: Make sure your device is unlocked and hold it to the terminal, no need to open the app.

- For Apple Users: Just hold your iPhone near the reader with your finger on Touch ID® or double-click the side button on your Apple Watch®, then hold it near the reader.

- For Samsung Users: Swipe up to launch the app, secure with authentication (either your fingerprint or passcode) and hover over the card reader to pay.

-

Cambridge Savings Bank will not automatically update your card information in your wallet.

You can delete your old Cambridge Savings Bank debit card from your device and add the replacement card, which will create a new device account number.

-

There is no cost for using your Cambridge Savings Bank debit card in your Mobile Wallet.5

-

Yes, you will continue to receive the same protection that you enjoy today with your Cambridge Savings Bank debit card.

-

Card Control enables you to control your debit card(s) using Online Banking or Mobile Banking. Turn your card on and off, block certain types of merchants, transactions, and even set a spending limit. It's up to you! You'll also be able to set alerts to track your finances.

-

Log in to CSB Online or Mobile Banking. Locate Card Control from the main menu in Online Banking or from the More menu in the CSB mobile app.

-

You must register for Online Banking to use Card Control.

To register, you may:

- Give us a call at 888.418.5626

- Visit your local branch

Once you are enrolled, you may access Card Control via Online Banking or through the CSB mobile app.

-

Log in to the CSB mobile app. If the card is not already in your wallet, you will see an Add to Apple pay, or if you are using an Android, you will see an Add to Google wallet button under the card.

-

In the Manage Card section, click on Manage Travel Plans. Click the + button next to Add Travel Plan. You will need to receive a one time passcode to either your phone as a text or by email. The next page you will choose the destination and travel dates, then click Submit.

Note: You can add up to 2 Travel Plans per card and within each Travel Plan Max of 15 destinations.

-

The Spend Insights section will show you the total amount you have spent during each month. It will also tell you what you used your card for, when you used your card, and where you have used your card.

-

No, there is no charge for this service.

Note: For text alerts, standard text message and data rates may apply.

-

From the first/main screen you encounter in Card Control, tap on the toggle switch to turn your Debit Card ON or OFF.

Note: Card Control changes are effective instantly.

-

To switch cards if you are in Online Banking, click the drop down arrow next to where it reads Switch or Add Card. In the mobile app just swipe the current card picture over to the left. If you have additional cards you will see a new card.

-

Any recurring debit card payments will continue to process normally.

All other debit or credit card transactions, including ATM withdrawals and cash advances, are blocked.

-

In the Manage Card section, click on Controls & Alerts. Under the controls section you can customize by Region, Merchant Type, Transaction Type or Spend Limits.

-

In the Manage Card section, click on Controls & Alerts. Click on the Alerts link and here you can alert for all transactions, no transactions or alert for selected transactions.

-

In the Manage Card section click on Controls & Alerts. Under the Alerts tab, click the radio button next to No transaction alerts.

-

Generally, text and email alerts are received less than a minute after the authorization of a transaction. However, that timing may be impacted by your individual carrier and the cell coverage you have at the time.

-

If one of your cards is lost or stolen, please turn your card OFF and then contact us at 888.418.5626 to report the card as missing or stolen and request a new one or visit your local branch to get a new card instantly. Once you receive your new card you will need to go into the Card Alerts tool and manage your settings for the new card. The Card Alerts tool does not close a card.

-

Navigate to uChoose Rewards from Card Control. You can click on the Rewards link within Card Control to navigate to the uChoose Rewards and redeem points for goods and services or can get cash back.

Credit Score

-

It’s a comprehensive Credit Score program that helps you stay on top of your credit. You get your latest credit score and report and an understanding of key factors that impact the score. With this program, you always know where you stand with your credit.

Credit Score also monitors your credit report daily and informs you through online banking and by email if there are any big changes detected such as: a new account being opened, change in address or employment, a delinquency has been reported or an inquiry has been made. Monitoring helps users keep an eye out for identity theft.

-

Your Credit Report will provide you all the information you would find in your credit file, including a list of current and/or previous loans, accounts, and credit inquiries. You will also be able to see details on your payment history, credit utilization and public records that show up in your file. When you check your credit report through this tool, there will be no impact to your score.

-

The Score Simulator is an interactive tool that allows you to simulate various actions you may take and see how your score could be affected. Different actions, like paying off a credit card balance might make your score move up or down. Just like checking your credit score and report using this tool, using our simulator does not affect your actual credit score.

-

No. Access to your credit score and report are entirely free, and no credit card information is required to enroll. Simply log in to Online or Mobile Banking to enroll and get started!

-

As long as you regularly access Online Banking, your credit score will be updated every 7-days and displayed within your Online Banking screen. You also have the ability to refresh your credit score and full credit report every 24-hours by clicking “Refresh Score” by navigating to the detailed Credit Score Dashboard from within Online Banking.

-

Our Credit Score tool pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform among the three bureaus to provide consumers a better picture of their credit health.

-

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions may use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be considered when calculating a score and each model may weigh credit factors differently, so no two scoring models are completely identical but should be directionally similar.

-

No, Cambridge Savings Bank does not have access to your credit file unless you choose to share with us. However, if you would like to share your credit report with your financial institution or any trusted party, you can easily download your credit report by navigating to the “Credit Report” tab and clicking “Download Report”.

-

The Credit Score tool uses bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

-

The Credit Score tool makes its best effort to show you the most relevant information from your credit report. If you think that any of the information is inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing corrections with each bureau individually. Each bureau has its own process for correcting inaccurate information, but every user can “File a Dispute” by clicking on the “Dispute” link within their Credit Report. However, The Consumer Financial Protection Bureau website offers step-by-step instructions on how to contact the bureaus and correct errors.

-

No. Checking your credit score or report using this tool is always a “soft inquiry”, which does not affect your credit score. Typically, lenders use ‘hard inquiries’ to make decisions about your credit worthiness when you apply for loans.

-

Yes. After you have enrolled in Credit Score for the first time, your report will be monitored, and you'll receive email alerts when there’s been a change to your credit profile. When applicable, you can also find these monitoring alerts within your Online or Mobile Banking.

-

Yes, you can easily choose when and how you're contacted. Navigate to the “Resources” tab and then under “Profile Settings” you can choose which email notifications you would like to receive. The Credit Score tool sends out three types of emails: Credit Monitoring Alerts, General Messages and Monthly Notices. You will automatically be enrolled in all email communications and can easily unselect the specific email types you wish not to receive.

CardValet

General

-

CardValet works with the most recent mobile operating software as well as two past generations of Android and iPhone devices.

-

CardValet currently supports CSB Consumer and Business debit cards.

-

CardValet automatically logs the user off after 10 minutes of inactivity.

-

Yes, the Card Details screen displays the Card Status —Active, Inactive, or Restricted.

-

No, there is no charge for adding this service.

Transactions

-

Yes, the app shows the last 50 debit card-based transactions posted within the last 30 days.

-

There are some merchant types where a merchant will pre-authorize the card for an amount that may be larger than the actual transaction amount. In this instance the pre-authorization amount must meet the threshold spend limit.

-

CardValet controls are only invoked during authorization of a transaction. In some cases, such as Gas Stations, a card may be tested for validity by doing a $1 pre-authorization, and the actual transaction amount is charged to the debit card after the transaction. Some gas stations will preauthorize for a maximum amount, e.g. $126, and some gas stations will check validating, e.g. $1. In the latter case, the actual transaction amount may exceed the limit, while in the former case, an authorization may be denied.

-

When you log on to the CardValet application, a Balance Inquiry transaction is performed to retrieve and display the balance. A balance inquiry is performed on every account listed. The application will not initiate more than one balance inquiry within 30 minutes even if you press the Refresh button. You should always reference online banking, mobile banking or ATMs for latest account balances.

-

CardValet only shows the transactions that are performed with the debit card. It does not show the transactions that are done on the account but without using your debit card, such as teller transactions or bill pay on an account. You should always reference online banking, mobile banking or ATMs for latest account balances.

-

The balance will be updated to reflect non-debit card transactions. The balance is updated the next time you log into CardValet. You should always reference online banking, mobile banking or ATMs for latest account balances.

Controls & Alerts

-

The My Location controls and alerts will check to ensure the merchant location is within a five (5) mile radius of the device set as “primary” within CardValet. These controls impact “card present” transactions only, therefore internet transactions are not impacted.

-

CardValet ignores location information that is more than 8 hours old. So, if the phone is off for more than 8 hours My Location controls will not take effect, and the transaction will not be denied on the basis of the old location information.

-

CardValet performs a proximity check at the granularity of ZIP code or city, so if the merchant is close to home then the transactions will still go through.

-

Yes. International transactions can be blocked using the “International” location control. Transactions will be limited to the United States.

-

Previously authorized recurrent payments will continue to process and will bypass the CardValet edit checks.

-

Settings take effect as soon as the “Updating information” message in the app stops.

-

You can set the “Do Not Disturb” time that will suppress notification during the set times. Some notifications will still be delivered, for example any transaction denial or any transaction that is a card present authorization.

-

CardValet alerts are sent as push notifications to the phone. The alerts also display under “Messages” in the CardValet app.

Fraud Alert Text Messages

-

Fraud alerts sent via text message are a way for Cambridge Savings Bank to notify you if there is a suspicious debit card transaction on your account. The alerts are triggered when a debit card transaction has been identified as suspicious. For example, charges outside of your usual purchasing patterns, from a different location, or with an unusually high amount may trigger an alert.

-

If you have a current mobile phone number on file with us, you will automatically be enrolled in fraud alert text messages.

Should you need to update your mobile phone number, you may do so by calling us at 888.418.5626, stopping by your local branch, or sending a Secure Email through your Online Banking. -

The number (or short code) that displays on fraud alert text messages is 37268. If you receive a text message from any other number alleging to be a Cambridge Savings Bank fraud alert, please disregard and reach out to us at 888.418.5626 at your earliest convenience.

-

The format for fraud alert text messages is as follows:

FreeMSG Cambridge Savings Bank 1-833-735-1897: Reply YES or NO if you used debit card ending ####, (Merchant Name) in (ST), $XX.XX. STOP to opt out. -

We do not charge for fraud alert text messages from 37268, but standard text message and data rates may apply.

-

If we suspect fraudulent activity on your debit card, we will send you an alert. Depending on the charge in question, your card may be blocked. When you receive the alert, we will look for you to either:

- Reply “YES” and confirm that you are in fact the one making purchases with your debit card and that the activity should NOT be considered fraudulent. If you respond “YES” your debit card will not be blocked from making further purchases and any block placed will be lifted.

- Reply “NO” and indicate that you are not the one making purchases with your debit card and that the activity should be considered fraudulent. If you respond “NO” your debit card will then be blocked from making further purchases, if it was not already.

-

Yes, if you validate the transaction as not being fraud by responding “YES”, indicating you tried to make the suspected purchase, it will be updated in our fraud system. You can attempt the transaction again, usually within 5–10 minutes of your response call or text.

-

Text messages will be sent from 8:00a.m. – 9:00p.m. relative to the local time in your mobile phone’s area code time zone.

-

You can reply “STOP” and will no longer receive the debit card fraud alerts via text. You will be immediately unenrolled in this service. However, you will still continue to receive debit card fraud alerts via phone call.

If you did not intend to unenroll from this service, you may then reply “UNDO” to cancel that action. -

You can simply reply “HELP”, and we will provide you with a phone number to call for further information. Alternatively, you can call our Contact Center at 888.418.5626.

-

Yes, we recommend that you contact us as soon as possible so we can help you fill out the necessary fraud documentation and contact the proper authorities.

TLS Security Software Upgrade

-

TLS stands for “Transport Layer Security.” It is a protocol that provides privacy and data integrity between two communicating applications. It’s the most widely deployed security protocol used today, and is used for web browsers and other applications that require data to be securely exchanged over a network, such as access to CSB’s Online Banking platform. TLS ensures that a connection to a remote endpoint is to the intended endpoint through encryption and endpoint identity verification.

-

In an effort to provide the highest level of security for our customers, we will be disabling connection to Online Banking from devices using any Transport Layer Security (TLS) less than 1.2.

TLS 1.0 and TLS 1.1 will be disabled on March 28, 2018 at 9:00pm and Users need to have devices capable of TLS 1.2 or higher in order to access CSB’s Online Banking (via web or mobile). To avoid any interruption in service, we recommend you ensure all of your systems and devices support TLS 1.2 or higher prior to March 28, 2018.

-

To avoid any disruptions in service, we recommend that you upgrade your software or equipment prior to March 28, 2018, which is when we will be disabling TLS 1.0 and TLS 1.1.

-

Below is a list of the minimum browser versions and Operating Systems (OSs) that are available for use on our Online Banking and support TLS 1.2 & higher. CSB always recommends keeping your Operating System (OS) and browsers up to date and patched.

BROWSER / OS

VERSIONS

Internet Explorer (IE) / Windows* 7, 8.1 11 Edge / Windows 10 13+ Chrome

33+Firefox

35+Opera 24+ Safari / OS X 10.10+ 8+ Android OS Browser 5.1+ Apple iPhone Safari / iOS 7+ Windows XP and Vista are no longer supported by Microsoft and should not be used. If you have a computer that is running these OSs it is likely 7+ years old and will need to be replaced as modern Operating Systems will likely not be compatible with your hardware.

-

Yes. Windows XP and Windows Vista are only capable of upgrading up to Internet Explorer version 8. Therefore, anyone using Internet Explorer as their browser will not be able to connect to our Online Banking. The other major browsers mentioned above have also stopped support for Windows XP and most for Vista as well. Chrome 50+ and Firefox 43+ will not support XP or Vista. Apple Mac OS X 10.9 and earlier have older versions of Safari and will not support TLS 1.2.

-

If you are unable to connect to CSB’s Online Banking after we disable old encryption versions (TLS 1.0 and 1.1), please follow the troubleshooting instructions below. These steps will aid in determining the encryption issue you may have with connecting to Online Banking as it relates to this change:

- If you cannot connect to our Online Banking website you can test your OS/Browser by going to SSL Labs.

- Click on Test your browser:

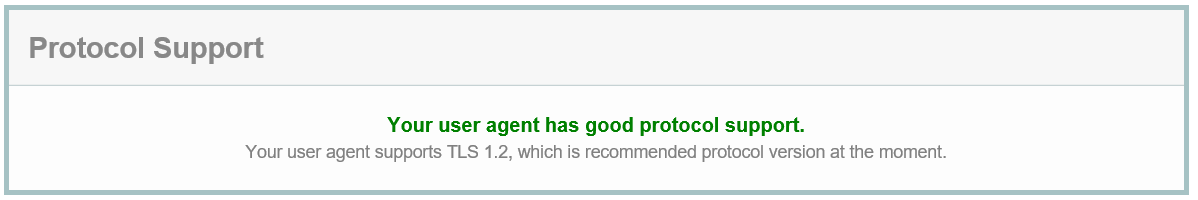

- Once the test is complete you should see the following under Protocol:

- If you do not, then you need to update your browser and/or OS

- If you cannot update your browser to be compatible then you will likely need a newer computer.

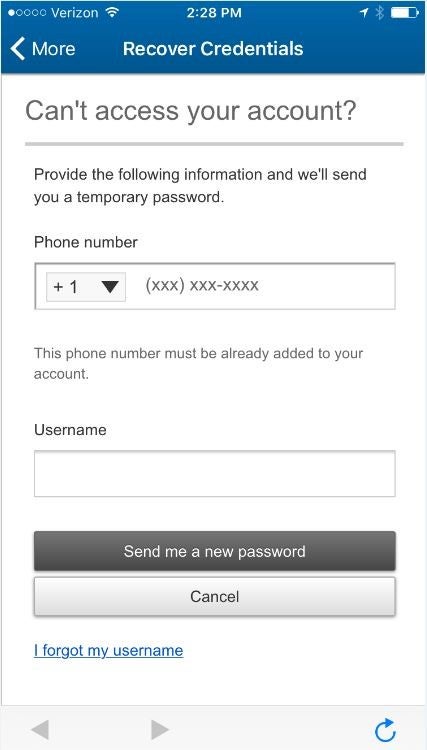

Username & Password Retrieval

-

If you have a phone number on file in your online banking profile, you can reset your own password.

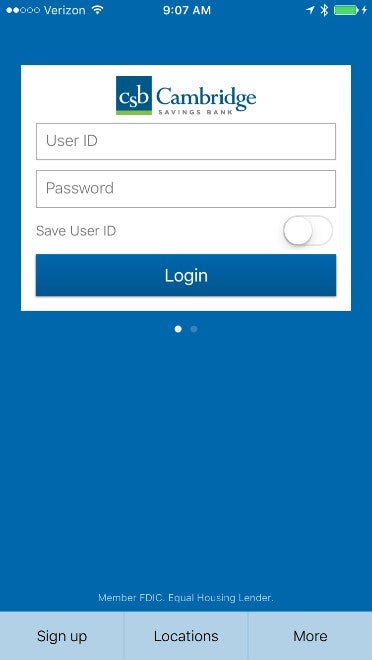

To reset your own password,

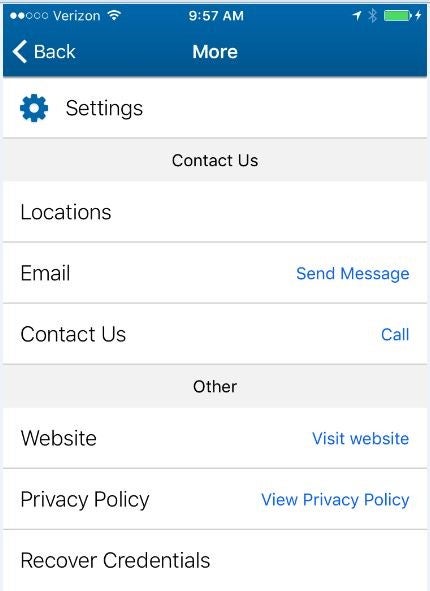

- Click on the More tab

.

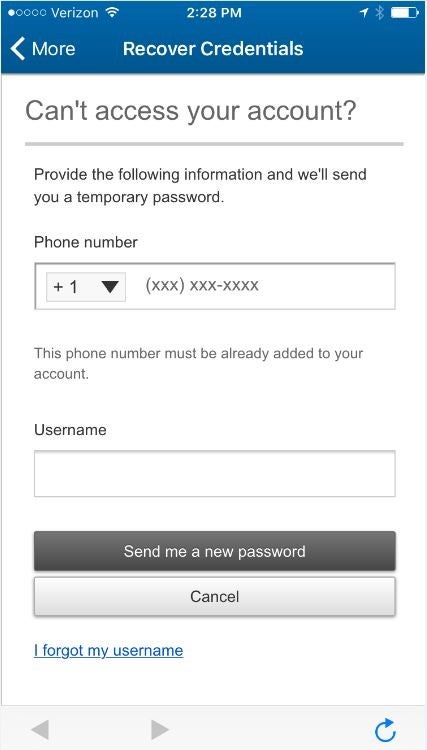

.2. Click on Recover Credentials.

3. Enter the phone number you have on file in your online banking profile

4. Type in your user name

5. Click the “Send me a new password” button.

If the phone number is enabled with text you will receive a text with the temporary password.

If the phone number is not enabled for text, you will received a phone call with the temporary password.

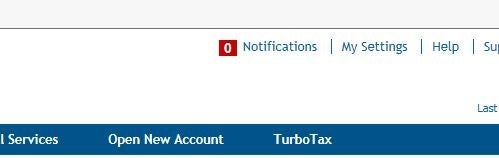

Note: To enable your phone for text, you should:

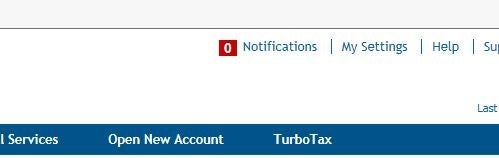

- Sign into your online banking account on a PC

- Click the My Settings tab in the top right corner of the screen.

3. In the Login and Security section you will be able to Add/Update phone numbers and enable them for text.

If you do not have a phone number in your online banking profile, you will need to contact us at 888.418.5626 to reset your password.

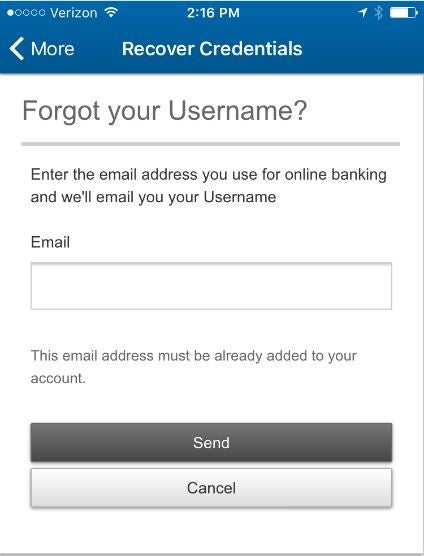

-

- Click on the More tab

- Click on Recover Credentials.

- Click the “I forgot my username” link at the bottom of the page and you will be brought to a page where you will need to enter your email address.

4. Enter your email address

5. Click “Send”

You must enter the email address that is in your online banking profile in order to have the username sent to you.

You must enter the email address that is in your online banking profile in order to have the username sent to you. -

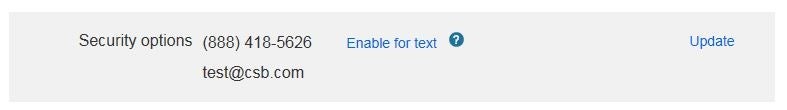

No, you must have a phone number in your profile in order to reset your own password. Please contact us so we can reset your password for you.

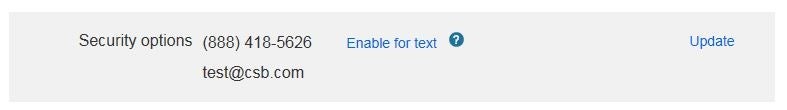

Once you are able to access your account again you should add a phone number by clicking on the My Settings link from the desk top version of Online Banking.

In the Login and Security section under Security Options you can click update to add or change a phone number.

-

Your CD will automatically renew at maturity, and you will have 10 calendar days once it matures to make changes to your account. The renewal term will be the same as your current term, except for CD Specials. CD Specials will renew for the closest shorter term to your current term. The renewal will be at the standard interest rate and Annual Percentage Yield (APY) in effect at maturity.

Using our CD Management tool in Online or Mobile Banking:

In Online Banking, select Account Management, then CD Management.

In the Mobile App, select More, then CD Management.

- Notifying us of changes through secure email within Online or Mobile Banking.

- Call us at 888.418.5626

- Completing the Certificate of Deposit Authorization to Change form which is mailed 45 days in advance of your CD maturity.

Forms can be mailed to:

1374 Massachusetts Ave

Cambridge, MA 02138Or brought to your local branch.

-

Once your CD reaches maturity, you will have 10 calendar days to make changes to your account.

Using our CD Management tool in Online or Mobile Banking:

In Online Banking, select Account Management, then CD Management.

In the Mobile App, select More, then CD Management.

- Notifying us of changes through secure email within Online or Mobile Banking.

- Call us at 888.418.5626

- Completing the Certificate of Deposit Authorization to Change form which is mailed 45 days in advance of your CD maturity.

Forms can be mailed to:

1374 Massachusetts Ave

Cambridge, MA 02138Or brought to your local branch.

-

You may close your CD early but will incur a penalty for early withdrawal. Please refer to your account disclosures to calculate the amount of the penalty. Please contact us at 888.418.5626 for more information or to request an early closeout withdrawal.

-

You can only withdraw interest credited in the term before maturity of that term without penalty. You can withdraw interest any time during the term of crediting after it is credited to your account.

You may make withdrawals of principal from your account before maturity. Principal withdrawn before maturity is included in the amount subject to early withdrawal penalty. Except in cases of a complete withdrawal, no such withdrawal before maturity shall reduce the remaining balance of the account below the $1,000 minimum balance (not applicable to Retirement accounts). Please refer to the Understanding Your Deposit Account Handbook to determine the amount of the penalty. For any withdrawal outside of the maturity grace period, please contact us at 888.418.5626.

-

You may contact us through secure email in Online or Mobile Banking, call us at 888.418.5626, or return the Authorization to Change form to prearrange any changes to be completed at maturity. Changes may be made through the CD Management tool in Online and Mobile Banking only at maturity and within the following 10-calendar day grace period.

-

Yes, you may withdraw funds from your matured CD and transfer them to your other CSB accounts. After clicking the Renew button next to your matured CD, use the dropdown menu on the following page and select Renew and withdraw funds to transfer funds from your matured CD to an existing CSB account.

-

Yes, you may add funds to your matured CD from a CSB checking or savings account. After clicking the Renew button next to your matured CD, use the dropdown menu on the following page and select Renew and add additional funding to transfer funds from an existing CSB account to your matured CD.

-

To change to a different term CD, click the Renew button next to your matured CD and use the Select Term dropdown on the following page to view/select a different CD term.

-

No, CSB does not currently support direct transfers to/from your CD to an external account.

-

You may withdraw funds from your matured CSB CD via wire transfer. To submit a wire request, use the Domestic Wire Transfer Request form located under the Additional Services menu option in Online Banking.

Note: As a courtesy, CSB will waive the normal processing fee charged for performing a wire transfer when wiring funds to/from a matured CSB CD.

-

Yes, you may close your CD using the CD Management tool. After accessing CD Management from the Account Management menu, click the Close button next to your CD to transfer the funds into an existing CSB account. Closures may be made through the CD Management tool in Online and Mobile Banking only at maturity and within the following 10-calendar day grace period. If you do not have an existing CSB account, please contact us through secure email in Online or Mobile Banking or call us at 888.418.5626 to make other arrangements.

-

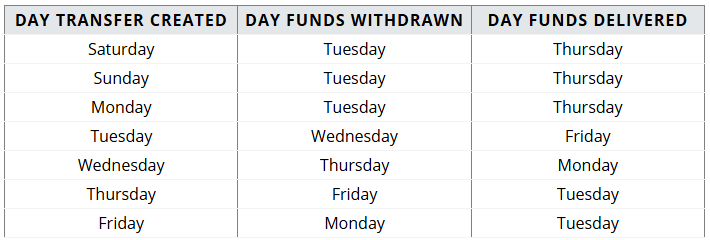

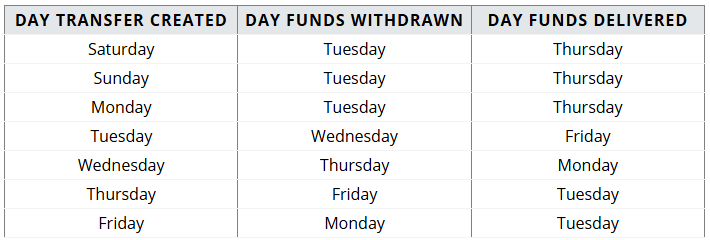

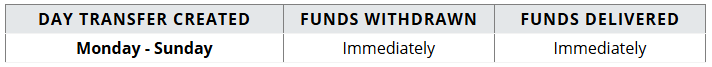

Transfers generally take 3-4 business days to complete, meaning transfer delivery times will vary depending on the day of the week the transfer is created. The table below outlines the delivery timeline by day of the week.

Please note:

- The cutoff to create a transfer is 1 AM ET. For example, if a transfer is created before 1 AM ET on Tuesday, it will be considered created on Monday (if both days are business days).

- Funds are withdrawn and delivered before business hours on the day listed.

- Cambridge Savings Bank may delay the delivery date for some customers. We will email you if this happens.

- Transfers created on a holiday will follow the same timeline as the next business day.

-

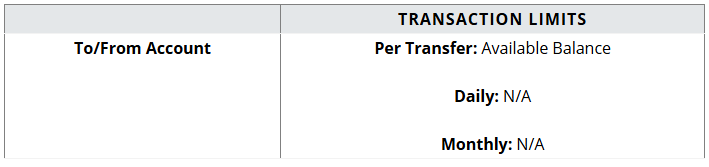

eTransfer

Inbound Daily: $15k

Inbound Monthly: $25k

Outbound Daily: $15k

Outbound Monthly: $25k

Expedited: $2k ($8 fee)Zelle®

Daily: $1k

Monthly $5kTerms and conditions apply. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

-

-

-

No, a debit card will only be ordered if you select that you want one during the online account opening process. If you didn’t select the debit card option, simply contact us to order one or stop by a branch to get one printed on the spot.

-

If you selected that you want a debit card during the application process, a debit card will automatically be ordered and linked to your checking account.

Your Digital Card: You may access a digital version of your card instantly via the Card Control tool in our mobile app. Simply add it to your mobile wallet to start using.

Your Physical Card: Your physical card will arrive in the mail within 7-10 business days, or you can stop by a branch and get one printed on the spot.

-

If you selected to receive a debit card, it will automatically be linked to your checking account.

If you'd like your debit card to also be linked to your savings account, please contact us so we can assist with linking it. -

Yes, you may request a debit card to access your savings account. Please contact us to request a debit card.

-

If you didn’t select the debit card option when opening your account online, simply contact us to order one or stop by a branch to get one printed on the spot.

-

The Mastercard ABU service securely provides account changes (e.g. card number and expiration date updates) for your business and personal debit card to participating merchants that you’ve set up to receive recurring payments. Mastercard’s ABU program helps reduce transaction declines that occur due to changed card numbers and expiration dates.

-

If the new card replaces an old card on an existing account, the Automatic Billing Updater service notifies participating merchants of the new card.

-

There is no specific list of merchants that have opted in to this service. Mastercard Automatic Billing Updater can apply to recurring payments and merchants where your card was saved on file. Always confirm with merchants that your updated card information has been received.

-

Mastercard’s Automatic Billing Updater helps reduce transaction declines that occur due to changed account numbers and expiration dates.

*You are still obligated to ensure that merchants have correct account information on file; failure to do so may result in a declined payment. Not all merchants participate in the ABU service.

-

If you wish to opt out of this service, please contact us at 888-418-5626, send us a Secure Email through Online Banking or visit your local branch.

Connect With Us

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Apple, the Apple logo, iPhone, iPad, Apple Pay, 3D Touch, Touch ID, iTunes® and Apple Watch are trademarks of Apple Inc., registered in the U.S. and other countries.

Android, Chrome, Google Pay, Google Play and the Google Logo are trademarks of Google LLC.

Samsung Electronics America, Inc. Samsung, Samsung Pay, Galaxy S and Galaxy Note5 are all trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Money Market

2 Transfers from statement savings or money market accounts to another account or to third parties by check, preauthorized, automatic, telephone, facsimile, or computerized transfers are limited to six transfers per calendar month. Continued transfers/withdrawals exceeding these numbers will result in the permanent restriction of those transfers. (For retirement money market accounts, you are not allowed any checks or drafts to third parties.)

Chip Card Tech

MasterCard is a registered trademark of MasterCard International Incorporated.

Mobile Wallet

3If your debit card is already connected to your iTunes® account, just enter the card security code within Wallet. Follow the instructions and you're ready to go.

4A Samsung account is required to use Samsung Pay.

5Cambridge Savings Bank does not charge a fee; however, standard data rates may apply from your wireless provider.