Deposit Results Report

Learn how to review deposit statuses and event history of all batches and items scanned.

This video is also available with audio description.

The Deposit Results report allows you to review a deposit status, event history, and images of all batches and items scanned via Remote Deposit Complete™.

TO GENERATE THE REPORT

-

Login into Business Online Banking, navigate to the Activities & Reporting tab and select Remote Deposit – New from the dropdown menu. Click the Login to Remote Deposit – New button.

-

From the Remote Deposit Dashboard, click Reports on the left side of the page.

-

On the right side of the page under Remote Deposit Complete Reports, select Deposit Results.

-

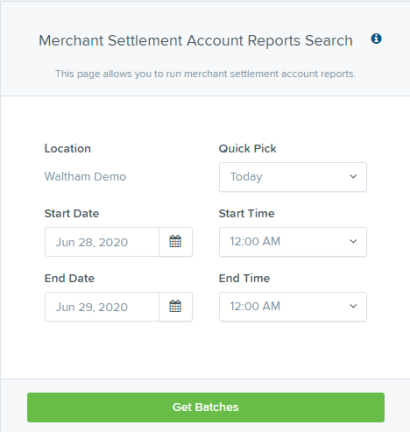

Select the location for which the deposit was created, and then choose the date range. The start date should be the date the batch was created. Click Get Deposits.

-

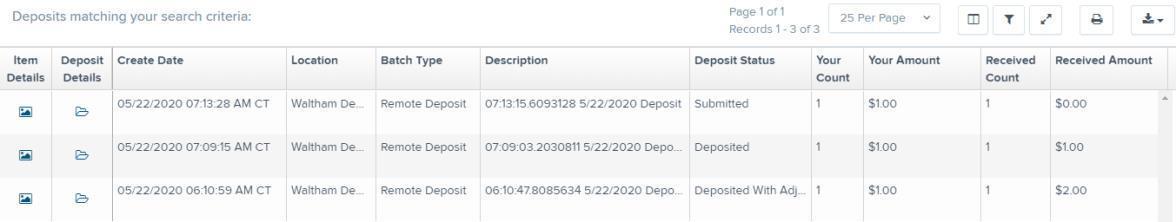

The report will be delivered to review on screen. Click

under Item Details to view individual items in the deposit. Click

under Deposit Details to see the event history for the batch, including deposits rejected upfront.

DEPOSIT RESULTS REPORT FIELD DESCRIPTIONS

Below are descriptions of the fields on the Deposit Results Report

| Field Name | Description |

|---|---|

| Item Details |

Click

|

| Deposit Details |

Click

|

| Create Date | The date the batch was created. |

| Location | The account into which the deposit is being sent. |

| Batch Type | The function used to create the deposit. |

| Description | Time and date stamp. |

| Deposit Account | The account number for the account into which the deposit is being sent. A deposit with multiple items that uses more than one deposit account will appear as Multiple. |

| Deposit Status | Current status of the batch |

| Your Count | Control count entered by the user when the batch was opened. |

| Received Count | Control amount entered by the user when the batch was opened. |

| Received Amount | Amount of deposit received by the system. |

| ACH Deposit Date | Not Applicable |

| ACH Deposit Count | Not Applicable |

| CS21 Deposit Date | Date Check 21 (C21) items will be deposited. |

| CS21 Deposit Count | The number of items that will deposit as Check 21 (C21) |

| CS21 Deposit Amount | The total amount of items that will deposit as Check 21 (C21). |

| Total Deposit Count | The total count of items that will be deposited for Check 21 (C21). |

| Total Deposit Amount | The total amount of Check 21 (C21) items that will be deposited. |

DEPOSIT STATUS DEFINITIONS

Knowing the status of a batch is important to the batch processing. A batch can be in any of the statuses listed below.

| Deposit Status | Definition |

|---|---|

| Approved | The transaction has been verified and will be processed at the next cutoff time. |

| Deleted | The entire deposit has been deleted by someone in your organization prior to closing it. The deposit may not be deleted once it has been closed. None of the items will be sent to transaction processing. |

| Deposited | All items have been processed successfully, and the deposit is in balance with no discrepancies or errors. These items are now in the Approved status, and an email notification has been sent. |

| Deposited with Adjustment | One or more of the items within this deposit caused an adjustment to the total deposit amount. The transactions have been sent to transaction processing with the adjusted deposit amount. An email notification has been sent. |

| Open for Scanning | A deposit has been created and is open to scan. Items can be scanned into this deposit until it is closed. |

| Partial Deposit | One or more of the items was removed from the deposit due to a duplicate or rejected item. The deposit has been sent to transaction processing with the deposit total minus the items that will not be processed. An email notification has been sent. |

| Rejected | This deposit status indicates the entire deposit has been rejected. A deposit is rejected when the adjustment amount exceeds the adjustment limit assigned by the bank or when all items within the deposit are rejected possibly due to all being duplicates. |

| Submitted | This deposit status indicates the deposit has been closed and the items are being reviewed for accuracy and errors. Once finished, the status of the items will change to one of the statuses defined previously. |

ITEM STATUS DESCRIPTIONS

Similar to the batch itself, the individual items within a batch will go through various statuses. An item can be in any of the statuses listed below.

| Item Status | Definition |

|---|---|

| Deposited | The item has gone through the keying and balancing process and will be in approved status until the next scheduled cutoff time. |

| Error | The item encountered an error and will need to be rescanned in a new batch. |

| Duplicate | The item was sent to transaction processing and rejected as a duplicate. The item will not be processed with this batch/deposit. |

| In Review | The item was flagged to ensure that the amount and MICR line are correct. The status will change once the corrections are made. |

| Needs Rescan | The item has a poor image quality or is a partial image. The batch/deposit will be re-opened so that you can rescan this item again in order for the batch/deposit to be processed. |

| Open | The item was scanned with no problems in an open deposit. Once the deposit status becomes Deposited, the item will be sent to transaction processing. |

| Rejected | The item has been rejected because it is a duplicate, has bad image quality, or cannot process through RDC (such as foreign checks.) |

VIEWING A LIST OF ITEMS IN YOUR DEPOSIT

-

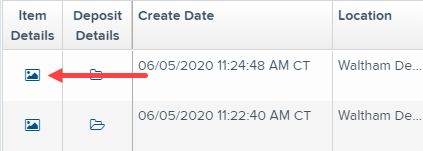

To see the list of items in the batch, click

View under the Item Details column.

-

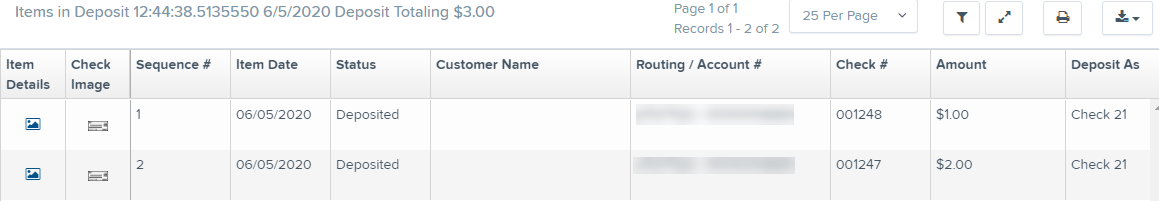

A list of items will appear, as show below. Under the Deposit Item column, click

View to see the event history of the item.

-

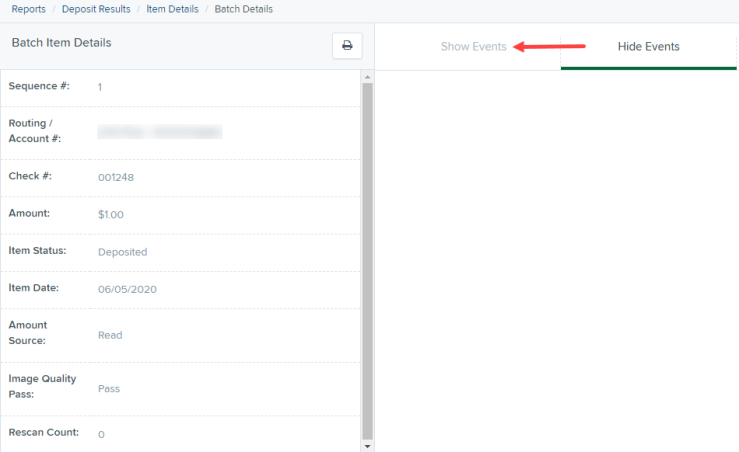

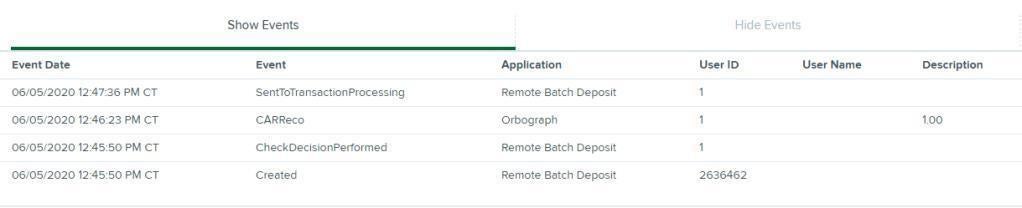

The details of the items will appear. Click Show Events to see the activity for individual items, as shown.

As displayed in the image below, the item’s event history is shown.

-

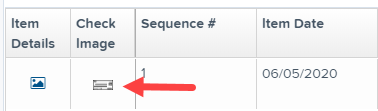

Click the link under Check Image to see an image of the item.

ITEM DESCRIPTIONS

Below are definitions of fields for individual items in the deposit.

| Field Name | Definition |

|---|---|

| Sequence # | Sequence or order number of the item in the batch |

| Item Date | The date the item was scanned. |

| Item Status | Status of the item. |

| Customer Name | If a customer name was keyed during data entry that information will appear in this section. |

| Routing/Account # | Displays the routing number and account number of the items scanned |

| Check # | Displays the check number if it is encoded on the MICR line of the item. |

| Amount | The amount captured for the item. Depending on the status of the item and batch, this amount could change after going through Item Processing. |

| Deposit As | Displays the transaction type(s) under which an item will deposit. All items must adhere to the processing options that have been enabled for the customer. |

| Amount Source | Will be read or keyed and has not impact on the processing of the item. |

| Image Quality Pass | Items can pass or fail. If the items fails, it will need to be rescanned. |

| Scanned Count | The number of times an item was scanned. |