Log-in & General Navigation

This video is also available with audio description.

LOG IN

To access the new Remote Deposit Capture platform, simply follow the instructions outlined below.

-

Enter your Company ID, User ID & Password

On the Business Online Banking login page, enter your Company ID, User ID and password, and click the LOGIN button.

-

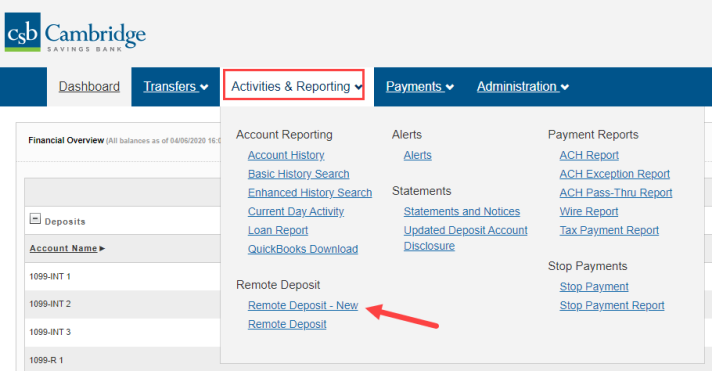

From the Dashboard homepage, click the Activities & Reporting tab and select Remote Deposit – New from the dropdown menu.

-

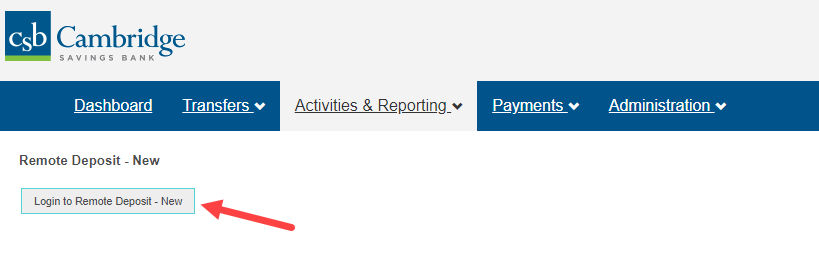

From the Remote Deposit – New page, click the Login to Remote Deposit – New button.

-

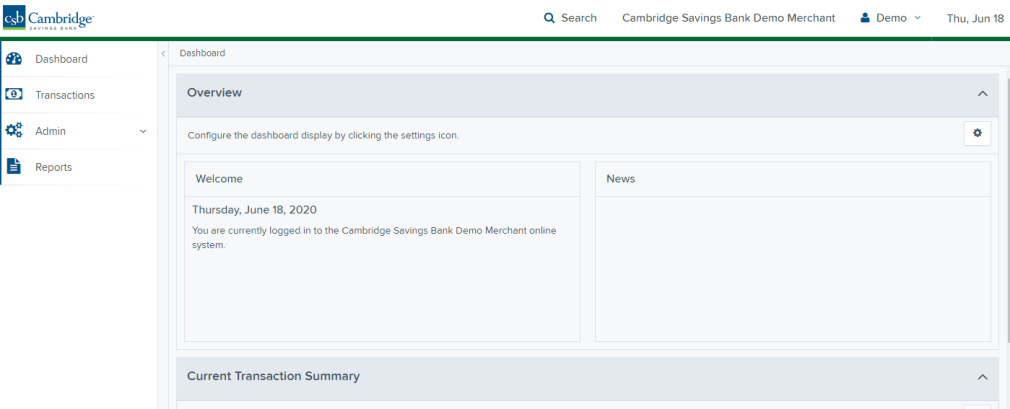

A new tab will open in your browser window. You will be directed to the Remote Deposit Dashboard.

The Overview panel contains a welcome message, a News pane and settings for the Dashboard page. The News pane is where Cambridge Savings Bank will display messages, alerts and FAQs. We recommend that you check the News pane periodically to ensure you are up to date on CSB Remote Deposit Capture updates.

LOG OUT

To log out of the Remote Deposit Capture platform, simply follow the instructions outlined below.

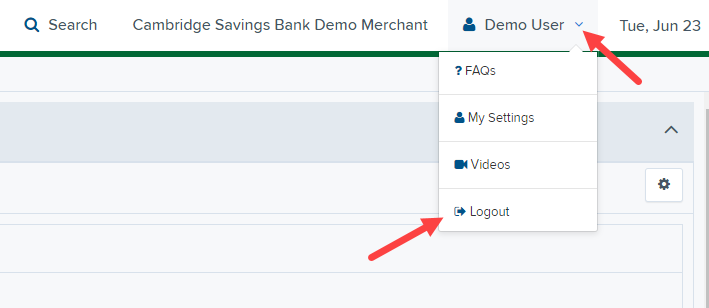

Next to your name in the upper right-hand corner click

and click Logout from the menu.

GENERAL NAVIGATION:

On the left side of the page you will find the main menu which contains Dashboard, Transactions, Admin and Reports.

Dashboard - The Overview panel contains a welcome message, a News pane and settings for the Dashboard page. The News pane is where Cambridge Savings Bank will display messages and alerts.The Current Transaction Summary displays a summary of the previous 60 days of transaction activity organized by status.

Transactions – In the Check Processing panel you will select Remote Deposit Complete to initiate a new deposit and review deposits that have not been submitted to CSB for processing. Bulk Operations will allow you to take action on multiple check items, at once. Bulk check operations are available depending on a transaction’s status.

Admin – If you have administrative rights you will be able to add, view and/or modify a user and their privileges for Remote Deposit Capture.

Reports – There are a number of ways to retrieve batch, deposit, and transaction information with this system. You will be able to generate pre-defined reports and/or create custom reports on a daily, weekly, and monthly basis as well as within specific date ranges.

OTHER NAVIGATION TOOLS

Use the Search button on the top menu bar to search for specific transactions, find a customer or access your settings.

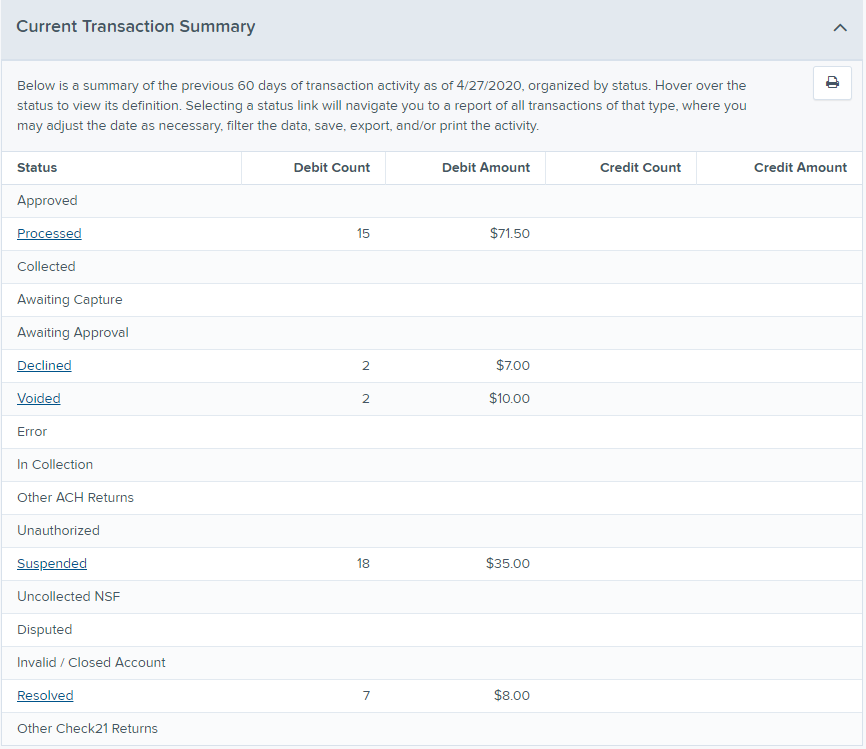

Current Transaction Summary

The Current Transaction Dashboard is a numerical display of the total number of items and dollar amounts of all Check 21 items for all locations being processed. It covers a rolling 60-day period and is broken down by a transaction’s current status within the system.

The following table provides a list and definition of all the transaction statuses within the system, for reference.

|

Transaction Status |

Definition |

|

Approved |

The transaction has been verified and will be processed at the designated cut-off time. |

|

Processed |

The transaction has been transmitted to the appropriate network (Check 21). Changes can no longer be made, and the transaction can no longer be voided. |

|

Collected |

Not Applicable |

|

Awaiting Capture |

Not Applicable |

|

Awaiting Approval |

The transaction has been verified, but the amount of the transaction exceeded the Dual Authorization limit of the user who created it. An authorized approver must review and then either approve or void the transaction. |

|

Declined |

The transaction has been declined by the system and will not be processed. The transaction exceeded either Dual Authorization limits or Velocity limits. |

|

Voided |

The transaction has been voided and will not be processed. A transaction may not be voided once the item is in the Processed status. |

|

Error |

An internal error has occurred within the system. Contact the Business Client Service team at 617-441-7051 for assistance. |

|

In Collection |

Not Applicable |

|

Other ACH Returns |

Not Applicable |

|

Unauthorized |

Not Applicable |

|

Uncollected NSF |

Not Applicable |

|

Suspended |

The transaction has been verified, but it has exceeded Velocity limits. |

|

Disputed |

Not Applicable |

|

Invalid/Closed Account |

Not Applicable |

|

Resolved |

The transaction has been moved into a Resolved status by a user to indicate that no further action related to the transaction is required. Transactions can be moved into a Resolved status from a status of Declined, Voided, or Error. |

|

Other Check21 Returns |

The Check21 transaction has been returned by the Federal Reserve. The transaction will be charged back. |